am watching a movie, "Locusts day of destruction". in the movie, genetically enhanced locusts in the lab escape into the wild and starts breeding, and then form huge infestation in Virginia and California Nappa Valley. Herbivourous locust after depleting crops turn carnivourous, attacking live stocks.

If the world is going to see a locusts storm, we are going to see agriculture food scare, and possibly ethanol shortage.

We have heard so much about, hurricane, ice storms, floods, so far, not a locust infestation yet.

Meanwhile California is having wild fires, people chased out of homes, before "foreclosure" of course.

When locusts come, it looks like a veil of black smoke stretching across the sky. Literally like the hand of GOD blocking off the sun.

While FED front runner Greg Ip tells market that FED would stop at 25bp cut and signal a pause. (if Greg is so great, why do FOMC meets for 2 days ? might as well disband the FOMC).

With NFP on Friday, FOMC possibly would have gotten wind of what might be there in NFP. If NFP is bad, they would have to forestall and cut 50 bp. B'cos the next FOMC is in June. Otherwise, market would go into a tailspin, and FED have to call for a impromptu FOMC.

Meanwhile, barring any surprise, liquidity is like Locusts storm gathering to take the Equities higher world wide.

For those who would want to trade next week NFP, FOMC, do subscribe to me at dollarproaragon@hotmail.com

There is a Scotland North Sea pipline strike. Expect Oil to retest 120 and possibly head higher into 125. And the another Iran, US skirmish (which the Iranian would gladly comply), would send it towards 150 (as what some commodity hotshot was toking). Meanwhile summer driving season is coming soon.

This would put a lid on any USD rebound next week.

I think the world is waiting on the next signal, Locusts, after the RED MOON, FALLEN STAR, EARTHQUAKE.

Monday, April 28, 2008

Saturday, April 26, 2008

26 Apr Negative Real Interest Rate

next week would be a crucial week. with market expecting only a 25bp cut.

the US data has been deterioriating last week, with historical low home sales, confidence, etc.

ECB has been talking about hiking to fight inflation.

If it turn out that FED cuts 50bp, and ECB keeps hawkish, and housing data week. It is definitely not the USD bottom yet.

a weaker than expected NFP would stall the current equities rally, putting a halt to the much anticipated May rally.

Hence the current action of SPX around 1390 would turn out to be distribution.

Expect an attempt of SPX towards 1405.

The mood in Asia is generally bullish.

I drop into a HK bank today, and they are offering Euro deposit at 4.2%/pa for 2 months.

Probably they are betting on a Euro drop. selling Euro high and buy back earlier.

If Euro stays breaks 1.6000 and hold there for a couple of months, it is going to be lots of pain.

On the other hand, Treasury sold off strongly on expectation of FED pause. and means funds are preparing to flow into Equities.

Possibly, a FED wait and see would lose precious time, while the stimulus program is not hardly stimulating.

This explains the Bear market formation. A first leg of drop, then a rebound and the final plunge into oblivion at SPX around 1000 to 1150.

Unless, FED can see a recovery on hand. However FED does not have a good record in forecasting turning points.

The latest housing statistics is pointing to a deteriorating housing prices, and more unsold homes.

If Euro is seems to be slowing, simply b'cos US is heading into a longer slump.

Hence a recovery in May is not realisitcs. While US is heading into recession, loans of higher grades, other than subrimes would be in peril. Hence the Banks would need to raise more and more capital. Eventually even nations would go bankrupt.

After failures of majot banks, we are going to see the fall of national central banks, possibly the Icelandic, and New Zealand central banks with huge budget deficit.

After next week cut, at 2% fed fund rate, US real interest rate would be negative. We may expect a outpouting of liquidty into the market. And that makes things really uncertain.

Hence ironically we may eventually have a roaring Equity while global economy is slowing down. And that is "irrational exuberance".

Poll

For those who think that FED would cut only 25bp, pls click on the Google ads above.

the US data has been deterioriating last week, with historical low home sales, confidence, etc.

ECB has been talking about hiking to fight inflation.

If it turn out that FED cuts 50bp, and ECB keeps hawkish, and housing data week. It is definitely not the USD bottom yet.

a weaker than expected NFP would stall the current equities rally, putting a halt to the much anticipated May rally.

Hence the current action of SPX around 1390 would turn out to be distribution.

Expect an attempt of SPX towards 1405.

The mood in Asia is generally bullish.

I drop into a HK bank today, and they are offering Euro deposit at 4.2%/pa for 2 months.

Probably they are betting on a Euro drop. selling Euro high and buy back earlier.

If Euro stays breaks 1.6000 and hold there for a couple of months, it is going to be lots of pain.

On the other hand, Treasury sold off strongly on expectation of FED pause. and means funds are preparing to flow into Equities.

Possibly, a FED wait and see would lose precious time, while the stimulus program is not hardly stimulating.

This explains the Bear market formation. A first leg of drop, then a rebound and the final plunge into oblivion at SPX around 1000 to 1150.

Unless, FED can see a recovery on hand. However FED does not have a good record in forecasting turning points.

The latest housing statistics is pointing to a deteriorating housing prices, and more unsold homes.

If Euro is seems to be slowing, simply b'cos US is heading into a longer slump.

Hence a recovery in May is not realisitcs. While US is heading into recession, loans of higher grades, other than subrimes would be in peril. Hence the Banks would need to raise more and more capital. Eventually even nations would go bankrupt.

After failures of majot banks, we are going to see the fall of national central banks, possibly the Icelandic, and New Zealand central banks with huge budget deficit.

After next week cut, at 2% fed fund rate, US real interest rate would be negative. We may expect a outpouting of liquidty into the market. And that makes things really uncertain.

Hence ironically we may eventually have a roaring Equity while global economy is slowing down. And that is "irrational exuberance".

Poll

For those who think that FED would cut only 25bp, pls click on the Google ads above.

Wednesday, April 23, 2008

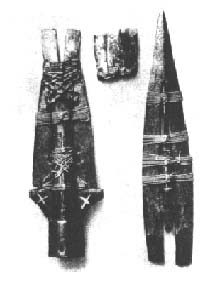

23 April The spear of destiny

If you want to know the Destiny of Jesus, subscribe to me at dollarproaragon@hotmail.com, and you would hold the "Holy Lance" which give you infinite power, the power to trade.

Here is a ridiculous story: 鞍山灵猪

In 2007, at a certain village in China, a PIG before she was slaughtered, spoke in human Chinese language, and said "this yr (the yr of pig) I am expensive, next yr it shall be rice, therafter there would be nobody living in houses"

In essence, we are seeing a rice price rally, next yr 2009, we would probably see a global property glut.

There are lots of Funds (Morgan Stanley Real Estate, Goldman Sachs, Dubai, etc) chasing properties prices in Asia (like Singapore, Shanghai, HK). In fact Singapore and Shanghai premier house prices is comparable to London, NY.

22 Apr Euro pass 1.6000

Saturday, April 19, 2008

2012-12-21 Doomsday

According to the Mayan calender, that is the the end of world.

what is the price of Euro on 21 Dec 2012 ? 2.012121 ?

China is now officially sending a representative to meet Sakorzy to discuss about Europe stance on the China Olympics and Tibetan rule.

the original nude picture of Sakorzy wife was purchased by Chinese during the last aution for 900,000 USD.

Chinese are turning out in masses in cities to protest Carrefour, the French supermarkt chain.

AND Sakorzy is anti-Euro.

The curtain is now raised...................

Thursday, April 17, 2008

17 Apr Monies making idea

Tuesday, April 15, 2008

15 April how not to lose monies

another false breakout, to get punters excited and then selldown again.

not to lose monies, stay out of GBP pairs.

Reason: Funds are stealthily accumulating British bluechips. E.g. A china fund just announced having bought a sizeable chunk of BP. As you know there are quite a lot of energy, resources bluechips on FTSE. Every uptick in GBP is sold into, making UK bluechips a good buy.

The SWF are out there mopping up US Banks, and UK energies.

UK Darling is now in China. Be careful.

|

Saturday, April 12, 2008

12 Apr G7 supports USD vocally

now, as I have warned G7 is now out in force supporting USD. no more talk of JPY to strengthen, but continued call for CNY to strengthen.

If USD strengthen, CNY would strengthen even more, de facto becoming the Last Saviour of the World.

if you want to know how to trade this, write to me dollarproaragon@hotmail.com for subscription.

If USD strengthen, CNY would strengthen even more, de facto becoming the Last Saviour of the World.

if you want to know how to trade this, write to me dollarproaragon@hotmail.com for subscription.

Thursday, April 10, 2008

10 Apr Market following my chart, incase you are not aware

Wednesday, April 9, 2008

9 Apr An elaborate deception in GBP.

First we look at the EURUSD chart, EURO indeed hit 1.5600 and bounced off as shown, though did not reach 1.5850 as indicated, it reached only 1.5800.

Hence the EURUSD chart should be able to fetch you at least 50 pips, more than enough for my subscription fee.

While I have always warned my subscribers against trading EURGBP and GBPUSD, as GBP pairs are highly manipulative. Look at the deceptive bullish triangle which broke down when every Technical chartist is betting on a break to the upside.

Unless your capital is not important, do not trade the GBP pairs.

In fact, before the breakdown in GBP b'cos of the weakest housing data (probably known by the funds long before), bank analyst was toking up buying GBPJPY.

If George Soros can bankrupt BoE then, you know how easy it is to manipulate GBP.

Monday, April 7, 2008

7 April G7

Subscribe to:

Posts (Atom)