As of 1 June, I have moved to dollarpro2009.blogspot.com..

I would no longer updating this site.

Monday, June 1, 2009

Sunday, May 31, 2009

31 May Making a Bear Case

GS on ladder.

STI in bullish pennant formation.Note the exceptional volume on last Wednesday 27 May.

HSI reached new height, but the volume is not. The ealier height commanded an exception volume.

Now everywhere is bull. Roubini has now admitted recovery is inplace. Paul Krugman was faster than him. I saw some pennant formation on Equities, Stocks like GS, JPM are on a rising escalator. (literally escalator, you dun need to move your feet). However we all know that the fundamentals are not there. I asked executives of major cooperations, they told me volumes would never go back to 2007 for another 1-2 yrs. Cooperations are going to cut cost, retrench staff to achieve earnings. Consumption would never return to high time. If you know the Japan lost decade and the explanation for it: "Balance Sheet Recession" (Richard Ko of Mizuho). Cooperations are more interested to reduce debt than to achieve profits.

The current abnormally high PE ratio of SPX has no fundamentals.

200 days at 928, easily achievable. ESmini has breached 200 days, not cash. 50 days at 861.

[Chart above: SPX weekly] the unconfirmed low at 666 gave the bull the might case for rally. However the huge histogram with the lower bars give the case for a pullback.

[Chart above SPX monthly] for those who are short the market. Goods news is that the Monthly SPX has confirmed the fall to 666, and another low is in the cards, let say in 1-3 yrs time. Not before a rally. This rally may not be straight up. PERHAPS, with a unconfirmed lower low at 500++, then surge back to 1100-1200. And the final drop 1-2 yrs from now, probably towards end 2010.

[Chart above TNX monthly] This is a bold prediction. 10 Yr Treasury yields to fall back to last low, before rising to new high, a awfully new high. (we all know Inflation is coming).

[Chart above TNX daily] Now comes the 10 year yields. It has been pulling back for 2 days. possible support is the channel lower trendline. Otherwise it may pull back all the way, which has greater significance. Either the yeilds is foretelling another bout of Debt Purchase by FED, or monies fleeing Equities into Bonds.

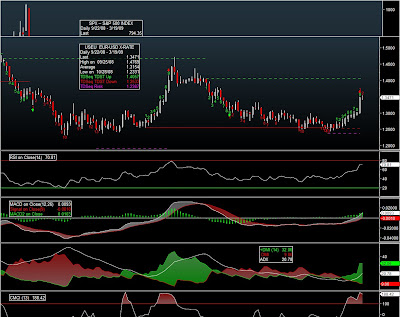

[Chart above and below Euro] For the EURO junkies, may be it is conincidence that the Euro rise stops at 1.4169, which is the max of W5 <= W3. Monday when Asia opens, we would have the answer. If the current large degree wave is complete (possibly a larger degree wave 3). To be followed by a larger degree w4. And the final larger degree w5, we would have possible 1.4500.

This Euro topping would be a strong case for a Equities pullback. Monday Asia opening would be telling.

After much thoughts as to the nature of this current rally: short squeeze, green shoots, reflation. I found the right word: "LOOTING". The bank executives, government officials are looting the American taxpayers, in return for favours, present and futures.

Would you work for 1 dollar salary like Edward Liddy of AIG ?

Geithner approved Fed NY chairman to purchase GS shares last yr in millions.

A recovering market can take its time, but a market staged by looters are in a hurry before the light comes.

When the market next plunge, it would give us a very good explanation.

Have to admit the odds are against me.

31 May June ? what's up

Coming 5 June may be a key reversal date. Two scenarios:

(A) we drop like a stone on Monday after ISM, especially after the spike on Friday closing trade. ES mini reach 927. Cash SPX reached 921.

Accoding to marketticker Daneric, he prefers that it was a last minute Short Squeeze taking out the stops from 915 onwards. And it was some big sell contracts taken out. Obviously some Biggies was positioning for selling.

Would that Big Sell guy comes into reposition shorts ?

If there is a drop, would 50 days 830 hold ?

(B) As the last minute surge has broken some key trendlines, necklines on some indices, e.g. NDX, is it a signal of the new breakout ? that would give the scenario of 5 days of rise towards 930-960

Hong Kong HSI has established new heights, same for Straits Times STI, however most of its component equities have not established new heights.

If scenario (A) takes shape, then we would have 10 years Treasury yeilds backing down. Flee to safety makes Tbills more attractive, prices go up, yields come down. This would be Bernanke preferred sceanrio. However 10 yr Treasury yields ($TNX) has already done the technical damage ( a breakout from a consolidation). How far can yeilds drop ?

Gold, Crude, EURUSD has to rally hard from here onwards, otherwise negative divergence spells trouble.(Higher high not confirmed by MACD).

An entire ship of Swine Flu victims (200 out of thousands) has been unloaded at Brisbane. It is of no worries at this point, bços it is not hign fatal form. However it is awfully infectious, nothing can be done about it. We just need the virus to mutate to a deadly form, then the outcome is known.

North Korea is now planning a long range missle (months ago, the missle fell into the sea prematurely). US has pledged stern action at the Shangrila-Dialogue over the weekend. It has now positioned Raptor fighters in Japan. North Korea nuclear program has Iran roots. Iran having presidential election in June. US is hoping that Admadinejadd would fail.

Crude official target may be 80 as declared by OPEC, OPEC secretary has said that the current rally is because of speculators, sentiments rather than Demand. Speculators would like push to 80 and decide, and we are not that far. With any impending military conflicts, we can easily climb above 100. Then SPX at 1000 would seem elusive.

Monday Asia would open strong to suck in more monies. Then ISM(May) would sway the actions.

GM

---

News has it "GM announced Friday that it will build a future small car in the U.S. at an idled UAW-GM facility, which it will retool."

why would American need small cars ? Italian needs small cars bços their cities are old and streets are narrow. Imagine a sub-powered small car on America vast and sprawling highways. Another scheme to cheat Tax Payer monies. Fritz Henderson can go down in history as in cahoots of the leagues of cheaters like Geithner and Bernanke.

GM shares reached a low of 72 cents. There were quite some buyers at 1 dollar, hoping that the Bankruptcy bid would fail. now there are at 30% loss.

GM wants to stop those small cars imports from China/Korea. They think they can make cheaper. Look at what India tata is selling Nano at only thousand USD.

GM would continue to be a drag on US economies, and sap the Treasuries of monies. Last heard another 30 billions on the tap for the new GM. All in the name of protecting American Autoworkers. BTW, bços of dealerships cuts, lot of pple would go unemployed as well as the Suppliers.

(A) we drop like a stone on Monday after ISM, especially after the spike on Friday closing trade. ES mini reach 927. Cash SPX reached 921.

Accoding to marketticker Daneric, he prefers that it was a last minute Short Squeeze taking out the stops from 915 onwards. And it was some big sell contracts taken out. Obviously some Biggies was positioning for selling.

Would that Big Sell guy comes into reposition shorts ?

If there is a drop, would 50 days 830 hold ?

(B) As the last minute surge has broken some key trendlines, necklines on some indices, e.g. NDX, is it a signal of the new breakout ? that would give the scenario of 5 days of rise towards 930-960

Hong Kong HSI has established new heights, same for Straits Times STI, however most of its component equities have not established new heights.

If scenario (A) takes shape, then we would have 10 years Treasury yeilds backing down. Flee to safety makes Tbills more attractive, prices go up, yields come down. This would be Bernanke preferred sceanrio. However 10 yr Treasury yields ($TNX) has already done the technical damage ( a breakout from a consolidation). How far can yeilds drop ?

Gold, Crude, EURUSD has to rally hard from here onwards, otherwise negative divergence spells trouble.(Higher high not confirmed by MACD).

An entire ship of Swine Flu victims (200 out of thousands) has been unloaded at Brisbane. It is of no worries at this point, bços it is not hign fatal form. However it is awfully infectious, nothing can be done about it. We just need the virus to mutate to a deadly form, then the outcome is known.

North Korea is now planning a long range missle (months ago, the missle fell into the sea prematurely). US has pledged stern action at the Shangrila-Dialogue over the weekend. It has now positioned Raptor fighters in Japan. North Korea nuclear program has Iran roots. Iran having presidential election in June. US is hoping that Admadinejadd would fail.

Crude official target may be 80 as declared by OPEC, OPEC secretary has said that the current rally is because of speculators, sentiments rather than Demand. Speculators would like push to 80 and decide, and we are not that far. With any impending military conflicts, we can easily climb above 100. Then SPX at 1000 would seem elusive.

Monday Asia would open strong to suck in more monies. Then ISM(May) would sway the actions.

GM

---

News has it "GM announced Friday that it will build a future small car in the U.S. at an idled UAW-GM facility, which it will retool."

why would American need small cars ? Italian needs small cars bços their cities are old and streets are narrow. Imagine a sub-powered small car on America vast and sprawling highways. Another scheme to cheat Tax Payer monies. Fritz Henderson can go down in history as in cahoots of the leagues of cheaters like Geithner and Bernanke.

GM shares reached a low of 72 cents. There were quite some buyers at 1 dollar, hoping that the Bankruptcy bid would fail. now there are at 30% loss.

GM wants to stop those small cars imports from China/Korea. They think they can make cheaper. Look at what India tata is selling Nano at only thousand USD.

GM would continue to be a drag on US economies, and sap the Treasuries of monies. Last heard another 30 billions on the tap for the new GM. All in the name of protecting American Autoworkers. BTW, bços of dealerships cuts, lot of pple would go unemployed as well as the Suppliers.

Saturday, May 30, 2009

30 May Crude to 66.6

Is it not errie that Crude has now reached 66.6, like SPX reached 666.

Was yesterday 29 May the point of inflextion, where Equities would plunge, and Crude turns lower ?

Now the market is bullish everywhere.

Was yesterday 29 May the point of inflextion, where Equities would plunge, and Crude turns lower ?

Now the market is bullish everywhere.

30 May sideway Equities and roaring Commodities

still having my QQQQ selling at 38 GTC. If there is a sell off next week, think 880-890 would hold for a buy. Douglas Kass has said this is a sideway market. It frustrates those johnly come lately Long and the permabear Shorts. Bernanke proviging a floor at 880, while those who long last year provide the ceiling. When the selling has receded the next big leg up would begin. as everyone is looking at 200days 935, think another short covering there would happen.

The market would dip when there is the slightest hint that Fed would have to hike rate. Crude would goto 80 and beyond, and consumers would start feeling the pinch, Gold probably over 1000 by then, EurUSD towards 1.5000.

The Big Whales have shifted their monies away from Equities to Commodities and Emerging Markets where monies are made faster and easier. Leaving we, EW traders, trying to guess every waves, calling every top.

In the end, does calling the right waves really make monies ? A lot of the punters out there dun even read news or know Elliot. They just buy on dips and sell rallies. Like buying the 888 on Thursday and selling at Friday close at 910.

The long term is still a bear markets, unfortunately most traders are still hounded in the short selling mode. Perhaps EW traders should divert their resources to EURUSD, Gold, Silver etc where the uptrend is clear inplace and target is clear

The market would dip when there is the slightest hint that Fed would have to hike rate. Crude would goto 80 and beyond, and consumers would start feeling the pinch, Gold probably over 1000 by then, EurUSD towards 1.5000.

The Big Whales have shifted their monies away from Equities to Commodities and Emerging Markets where monies are made faster and easier. Leaving we, EW traders, trying to guess every waves, calling every top.

In the end, does calling the right waves really make monies ? A lot of the punters out there dun even read news or know Elliot. They just buy on dips and sell rallies. Like buying the 888 on Thursday and selling at Friday close at 910.

The long term is still a bear markets, unfortunately most traders are still hounded in the short selling mode. Perhaps EW traders should divert their resources to EURUSD, Gold, Silver etc where the uptrend is clear inplace and target is clear

Friday, May 29, 2009

29 May GDP

Asia open holding up well. Asia is front running the US market. until we see a flip on Asia, otherwise do not expect anything dramatic on SPX. Cramer was right, if Oil, commodities are rallying, and Financials holding, SPX would continue to rally. Still SPX has unfinished business at the 200days mov avg.

As Geithner is in China 1-2 June, expect a good rally towards 930-940 coming Friday, next Monday to Tuesday. 200 days may be broken and SPX hug the 200 days for another month.

As crude official target allowed by OPEC is 80, expect Crude to inch towards 80. that would bring Euro towards 1.5000 and Gold breaking 1000.

The trigger may be the GDP today.

think the market is not going to give those who short Euro any breathing space, like those who shorted SPX. Euro is going to 1.5000.

BoA Meryll Lunch analyst Tenengauzer says on Bloomberg Euro would goto 1.200 by September, now Euro at 1.4100. seems like quite a lot of pple caught shorting Euro.

As Geithner is in China 1-2 June, expect a good rally towards 930-940 coming Friday, next Monday to Tuesday. 200 days may be broken and SPX hug the 200 days for another month.

As crude official target allowed by OPEC is 80, expect Crude to inch towards 80. that would bring Euro towards 1.5000 and Gold breaking 1000.

The trigger may be the GDP today.

think the market is not going to give those who short Euro any breathing space, like those who shorted SPX. Euro is going to 1.5000.

BoA Meryll Lunch analyst Tenengauzer says on Bloomberg Euro would goto 1.200 by September, now Euro at 1.4100. seems like quite a lot of pple caught shorting Euro.

Thursday, May 28, 2009

28 May Sell in May

GM last minute ask for more monies from the German government for selling Opel.

money grubbing americans sharing the same DNA as Geithner, Bernanke. Pulling out last minutes demands.

In Asia we have China companies listed in Singapore cooking their books, REITS offering rights issue, companies founders selling into the rallies.

The BEAST is now roaming WallStreet, reaping the souls.

The market dynamics has been the big whales taking profits from the Equities and buying up commodities, crude and gold.

EURUSD seems to have reached its short term peak at 1.4050, while Crude may be completing its at 65.

As the saying goes "Sell in May", it says sell in the whole month of May. And we do see Stock Equities literally stand still at the top and allows the whales to sell into it. Amazing.

It would be interesting to see what happens after Geithner finishes his China trip. Would he play the same tricks and demand more at last minute, which is what GM is literally asking the German government for more monies.

The Isreali is not yielding to Obama. Neither is the North Korean. The US government is significantly weaker than before.

There was a Chinese professor, a renowned figure as the head of public policy institute in Singapore, who claims that the status of USD is unshakeable, bços US has the finest weapons, most consumers, etc.

If US is so great, then it should have done better at Iraq, or the credit crisis would not have happened before. This goes to show that there are still hard core USD fans out there.

I dun know what is so great about US Tech companies, when companies are cutting down IT expenses. Even Microsoft itself is reining in its expenditure on IT and operations. Perhaps it allows its founders, owners, executives to cash out at higher level.

IT is money grabbing mania, at the expense of middleclass who believed that the Green Sprout would bear flowers.

The "Green Sprout" talk would continue to haunt Bernanke and Geithner next yr.

Incidentally, Geithner is always in intervals of a few days, talking up the economy, the banks. And it really sounds fishy.

money grubbing americans sharing the same DNA as Geithner, Bernanke. Pulling out last minutes demands.

In Asia we have China companies listed in Singapore cooking their books, REITS offering rights issue, companies founders selling into the rallies.

The BEAST is now roaming WallStreet, reaping the souls.

The market dynamics has been the big whales taking profits from the Equities and buying up commodities, crude and gold.

EURUSD seems to have reached its short term peak at 1.4050, while Crude may be completing its at 65.

As the saying goes "Sell in May", it says sell in the whole month of May. And we do see Stock Equities literally stand still at the top and allows the whales to sell into it. Amazing.

It would be interesting to see what happens after Geithner finishes his China trip. Would he play the same tricks and demand more at last minute, which is what GM is literally asking the German government for more monies.

The Isreali is not yielding to Obama. Neither is the North Korean. The US government is significantly weaker than before.

There was a Chinese professor, a renowned figure as the head of public policy institute in Singapore, who claims that the status of USD is unshakeable, bços US has the finest weapons, most consumers, etc.

If US is so great, then it should have done better at Iraq, or the credit crisis would not have happened before. This goes to show that there are still hard core USD fans out there.

I dun know what is so great about US Tech companies, when companies are cutting down IT expenses. Even Microsoft itself is reining in its expenditure on IT and operations. Perhaps it allows its founders, owners, executives to cash out at higher level.

IT is money grabbing mania, at the expense of middleclass who believed that the Green Sprout would bear flowers.

The "Green Sprout" talk would continue to haunt Bernanke and Geithner next yr.

Incidentally, Geithner is always in intervals of a few days, talking up the economy, the banks. And it really sounds fishy.

Monday, May 25, 2009

25 May Oil again

Yes, it is Oil again. Summer season, with the driving then the Hurricane coming. OPEC target at 70. happy with the production curb.

Euro/Oil has broken correlation with Equities. Used to be Equities rise, Euro rise, Crude rise. now it is Euro rise, crude rise and Equities fall.

US energy secretary Steven Chu says Oil spike would curb Economic Recovery.

HangSeng (HK market) priced in HKD (pegged to USD) has been lagging, while STI (Singapore market) has shown resilience. Think the market reflects deep seated current concerns.

China is still online to fill up its Four phases of Strategic Petroleum Reserve. Noting that China is still on subsidised petrol.

Crude climbs in a long steady trend. After it has broken out of its consolidation at 30-35, it is going to be a long hot summer.

Crude prices is something that Bernanke cannot control. Bernanke can control the Bank Equities prices, henceforth the Equities markets, he cannot control Crude, Gold.

He has lost his control of USD, and now faces his nemesis.

The best long opportunity is in Crude Futures, the best short opportunity is in the Emergig Markets. Too mucn of misplaced optimism in emerging economies on the fantasy that China can pull the world out of recession.

Having said that, Monday is the pullback day. hence expect Crude/Euro to test up channel support. personall expect Euro to 1.5000, Crude to 80 if not 100 again.

Collateral damage of this US credit crsis is its loss of moral authority over other nations. When pple from other nations see how corrupt is the US capital system. The communist, socialist power in the world has found renewed energy.

US has no more will nor monies to wage another war. Hence forth, North Korea, Iran would attain their nuclear ambition and set forh a decade of turmoil.

That explains why DOW is going to 3000, SPX to 400 in the long run.

The credit crisis and the ensuing recession is only the end of the Beginning of the Kondratieff Winter, and the Beginning of the End of the United States as a superpower.

Euro/Oil has broken correlation with Equities. Used to be Equities rise, Euro rise, Crude rise. now it is Euro rise, crude rise and Equities fall.

US energy secretary Steven Chu says Oil spike would curb Economic Recovery.

HangSeng (HK market) priced in HKD (pegged to USD) has been lagging, while STI (Singapore market) has shown resilience. Think the market reflects deep seated current concerns.

China is still online to fill up its Four phases of Strategic Petroleum Reserve. Noting that China is still on subsidised petrol.

Crude climbs in a long steady trend. After it has broken out of its consolidation at 30-35, it is going to be a long hot summer.

Crude prices is something that Bernanke cannot control. Bernanke can control the Bank Equities prices, henceforth the Equities markets, he cannot control Crude, Gold.

He has lost his control of USD, and now faces his nemesis.

The best long opportunity is in Crude Futures, the best short opportunity is in the Emergig Markets. Too mucn of misplaced optimism in emerging economies on the fantasy that China can pull the world out of recession.

Having said that, Monday is the pullback day. hence expect Crude/Euro to test up channel support. personall expect Euro to 1.5000, Crude to 80 if not 100 again.

Collateral damage of this US credit crsis is its loss of moral authority over other nations. When pple from other nations see how corrupt is the US capital system. The communist, socialist power in the world has found renewed energy.

US has no more will nor monies to wage another war. Hence forth, North Korea, Iran would attain their nuclear ambition and set forh a decade of turmoil.

That explains why DOW is going to 3000, SPX to 400 in the long run.

The credit crisis and the ensuing recession is only the end of the Beginning of the Kondratieff Winter, and the Beginning of the End of the United States as a superpower.

Saturday, May 23, 2009

23 May Summer

SPX final target at 939,

SPX never make it for the Double Top pattern. Otherwise 827.

Euryen in triangle formation, watch for breakout.

For those who follow this blog for forex, my personal target is 1.5000 for EurUSD, suspect the traders would take advantage of Monday low liquidity to drive towards 1.5000 for most part of it.

USD index finally below 80 after lunch. 70 is in view. However still not a crisis.

Friday, May 22, 2009

22 May Collapse of USD ? USD index broken support.

well, things happen really fast. and the USD index is now broken. PIMCO Bill Gross now talks about US rating downgrade. When Bill Gross speaks, you better listen. Last yr, when Euro slides to around 1.4000, he said USD has more upside, Euro slide to 1.2400 eventually.

Now Bill Gross says US would lose its AAA eventually, means it would happen soon. Reason: Obama has passed a bill to regulate the Rating Agencies. Hence the rating agencies now have to do their job. (US Debt should have lost its AAA long ago).

This is going to be scary, the Banks would have to start to revalue US debt on their books, US corporations have to pay higher interest for loans.

And now OBama wants to keep GM alive by pumping monies into GMAC. Whether GM goes Chapter 11 or not, the result is the same. Chap 11=> more job loss. Keep alive => more tax payer monies, while jobloss still happens.

The simplest solution is to take the pain now, close GM, Citigroup, BAC, and then the Democrats would still have a chance of winning next yr mid term. Otherwise, this drags on past this yr, and the American public would be really impatient.

Eur is whiskers away from 1.4000, GBP from 1.6000, and Crude from 65.

the smart whales have taken profit from Equity into Commodities, Crude, short USD. however they need to maintain the Equity to make their Commodities/Crude moves credible, in the face of economy recovery.

Due to low liqudity, we would expect today to be hghly explosive, Crude jumping, Euro towards 1.5000, etc. while Equity stage another rebound to 915 to suck in more monies.

The mantra is to suck in as much monies as possible.

and everybody knows how it would end up eventually. The longer it holds at current level, the harder would be the fall.

China would have to spend more USD buying up Commodities, while USD depreciates. This would speed up the depletion of China USD reserves. If you cannot pay back your debt, hope that you banker would go bankrupt.

With all the side monies around (thanx to Bernanke), it is quite difficult to go down actually. If it goes down, probably bços the Good Samaritans (GS) engineer one.

It would need a jolt, like the much anticipated St. Andreas fault eruption, mutation of H1N1 to a fatal strain, or some military conflict close to home, otherwise it is not likely.

Hence if you are shorts, dun be too greedy. Nonetheless if it is cheap, you can try your luck.

Now Bill Gross says US would lose its AAA eventually, means it would happen soon. Reason: Obama has passed a bill to regulate the Rating Agencies. Hence the rating agencies now have to do their job. (US Debt should have lost its AAA long ago).

This is going to be scary, the Banks would have to start to revalue US debt on their books, US corporations have to pay higher interest for loans.

And now OBama wants to keep GM alive by pumping monies into GMAC. Whether GM goes Chapter 11 or not, the result is the same. Chap 11=> more job loss. Keep alive => more tax payer monies, while jobloss still happens.

The simplest solution is to take the pain now, close GM, Citigroup, BAC, and then the Democrats would still have a chance of winning next yr mid term. Otherwise, this drags on past this yr, and the American public would be really impatient.

Eur is whiskers away from 1.4000, GBP from 1.6000, and Crude from 65.

the smart whales have taken profit from Equity into Commodities, Crude, short USD. however they need to maintain the Equity to make their Commodities/Crude moves credible, in the face of economy recovery.

Due to low liqudity, we would expect today to be hghly explosive, Crude jumping, Euro towards 1.5000, etc. while Equity stage another rebound to 915 to suck in more monies.

The mantra is to suck in as much monies as possible.

and everybody knows how it would end up eventually. The longer it holds at current level, the harder would be the fall.

China would have to spend more USD buying up Commodities, while USD depreciates. This would speed up the depletion of China USD reserves. If you cannot pay back your debt, hope that you banker would go bankrupt.

With all the side monies around (thanx to Bernanke), it is quite difficult to go down actually. If it goes down, probably bços the Good Samaritans (GS) engineer one.

It would need a jolt, like the much anticipated St. Andreas fault eruption, mutation of H1N1 to a fatal strain, or some military conflict close to home, otherwise it is not likely.

Hence if you are shorts, dun be too greedy. Nonetheless if it is cheap, you can try your luck.

Wednesday, May 20, 2009

20 May Euro cup and handle

Update 9:50 am ET.

Euro has broken out of formation, 1.5000 in target. Go long on retest.

prepare for a failure of the Cup and Handle pattern. at neckline 1.3700 to 1.3750.

mid to long term still bullish on Euro. If pattern fails, at least it would goto 1.3400, then 1.3000, whether to 1.2400, that would be known when it comes.

Crude trying to go higher, no fundamentals actually. Gold deserve to break 950.

Stock equities trying to go higher, but met with selling with those who long position since last yr. Trying to cash out.

Euro has broken out of formation, 1.5000 in target. Go long on retest.

prepare for a failure of the Cup and Handle pattern. at neckline 1.3700 to 1.3750.

mid to long term still bullish on Euro. If pattern fails, at least it would goto 1.3400, then 1.3000, whether to 1.2400, that would be known when it comes.

Crude trying to go higher, no fundamentals actually. Gold deserve to break 950.

Stock equities trying to go higher, but met with selling with those who long position since last yr. Trying to cash out.

Tuesday, May 19, 2009

19 May Goldilock

you can see the super high volume day for the Hang Sang Index.

For Eurusd, decision time, whether to break out of the CUP and HANDLE formation. Otherwise, it risks a steep fall.

Check EURGBP, Eur on verge of falling down vs GBP.

00:31 CNY News: Change of Policy on Investment Overseas May 19. The SCMP has

followed up on a Ministry of Commerce statement released yesterday urging

domestic companies to invest overseas. The State Administration of Foreign

Exchange (SAFE) also announced that it planned to encourage more investments

abroad by easing inspection procedures and expanding FX available for

investment. Added to this mix was an announcement by the National Social

Security Fund (NSSF) that it was seeking cabinet approval to invest billions of

dollars in private equity funds. The SCMP says this renewed interest in overseas

investment is in stark contrast to warnings earlier this year about the

political and cultural risks in foreign deals. If China is about to open the

"purse strings" then the big beneficiaries (if not already) would be Brazil,

Australia, Canada, South Africa etc. for obvious reasons.[/QUOTE]

Now China dun have a good track record of overseas investment. The fact that China government is pushing for investment overseas is akin to China forex investment corp buying up BlackRock in 2007.

The trick is to deplete China, and other sovereign wealth funds of their reserves, then when the next crisis comes, there would be no more monies for stimulus plan. When the entire world is in debt, we would head for the abyss. This takes time to happen. Probably by 2012, it would be most obvious.

The world has gone on a bull run since 1929 till 2007, an almost 80 yrs of bull cycle. The next 30 yrs is a bear market, with occasional bull rallies, like the one we are having. Hence the strategy for the whales is to grab as much monies as possible from the dolphins.

Wealth preservation is till the mantra. You would still be wealthier if you stay out of the market.

May be you take the ride now, with destination unknown. You may be ride the bull to the peak and then down into the abyss, back to where you are. The only person who benefit is your broker.

Update 1:35 am ET------------------

Crude just broke 60. a new recent high. or rather a new high for a long while. All those FED monies just went to the Banks, and the Banks sponsoring the Oil Index Funds to buy up Oil Contracts. and then the Oil Traders like Vitoil, who already have accumulated, tonnes of oil, start to push market up. In the coming Driving Season and Hurricane. Last yr with every hurricane, the oil gets beaten down lower. This yr, with every Hurricane, oil surges. Then they payoff the Nigerian guerillas to blow up some pipelines, while the Shell people just watch them. Oil stock goes up.

Suspect their target is 100 Dollar oil. Hence that make Euro easily 1.5000. You can either Long Euro/Oil now and put Trailing Stops and enjoy the ride up for 1000 pips, otherwise you trade in and out following my calls.

You would be surprised that your broker is long USD and now bleeding. When your broker cut loss, Euro would surge.

Monday, May 18, 2009

18 May Asia update

the market in Asia is generally weak. Nikkei perching on 9000. HSI gapped down, STI down but holding firm.

Martin Feldstein reported bearish. Credit cards defaults mounting.

Read Pg 844 of Bulkowski "Encyclopedia of Chart Patterns" and he relates his past experience and guess what ?

If you dun have his book, you can email me at dollarproaragon@hotmail.com.

Gold may a dash at 930 at Asia lunch time. Would it hold there ?

Earthquake Watch:

Richet 5 hit LA. no casualty. 1 km from Inglewood.

Waiting for Good Samaritans (GS) for the 100 meter Bull sprint before memorial holidays.

Martin Feldstein reported bearish. Credit cards defaults mounting.

Read Pg 844 of Bulkowski "Encyclopedia of Chart Patterns" and he relates his past experience and guess what ?

If you dun have his book, you can email me at dollarproaragon@hotmail.com.

Gold may a dash at 930 at Asia lunch time. Would it hold there ?

Earthquake Watch:

Richet 5 hit LA. no casualty. 1 km from Inglewood.

Waiting for Good Samaritans (GS) for the 100 meter Bull sprint before memorial holidays.

18 May Bull or Bear

Sunday, May 17, 2009

17 May What Recession ?

well, diverse views exist in the markets. some say the bouce from 878.94 was the bottom of the current down move, poised for a Wave 5 upwards to 930-960 to meet the 200 days moving average. Some say it would test the 50 days moving average at 830.

As for the sentiment on the ground, general public has been cautious however with optimism. In Asia country recent property launches has met with sales target comparable to those in 2007. Developers lower prices, and people with spare monies come to the market buoyed by the stock market rally.

The property overhang is still substantial with new completion coming online towards end of this year and next.

In China, there are 200 IPOs waiting for the Government green light. The Shanghai Stock Exchange is still at its peak. Hong Kong Index has pulled back but with low volume. There is no panic or worries. Moving averages have cross upwards, signaling Fund Managers to load up Equities. Analyst forecast China stock markets are in initial stages of Bull move.

In Asia, especially China, people throng the airports for inter-city flights, there is no lacking of shoppers.

As some may say, "What Recession ? ".

My forecast in a nutshell is a song :"Killing me softly with his song" a.k.a. slow boil frogs in water.

Nonetheless it is not a straight line down move, but with bull rallies in between. Hence rather difficult to trade for the Day traders, not certain of the genuine direction.

If you are in Long position, probably save up for the eventual rise end of month, if not end of year. If you are in Short, look to take profits along the way.

The low at 666 would be tested at somepoint, whether it wuld be broken towards 500, that would depend on the general mood. So far there is nothing to warrant even a drop below 700. Bços ban on short selling is coming, derivatives and CDS are going to be caged. Credit Spreads are at recent low. Monies is flowing again. Reflation trades are put back on.

Tice of Federated Investors who run the Prudent Bear fund is casted on weekend TV repeatedly talking about his view the low would be tested again and broken into 400-500this year.

A casual talk with my frens show that they are readily shorting the market with CFD, however holding some long positions as well. This guarantees that Volatility is in, and general folks have no idea where the market is heading, which they are made to believe.

When we see capitulation of this down move then the end has come, otherwise it is whipsawing to the downside.

Friday, May 15, 2009

15 May OPEX day. no stock volatility. Euro broke downward.

to be more constructive, I post a chart of EURJPY. do you see the Three Peaks and a Dome House ?

Shella Bair she says "credit crisis is over, I hope." She looks like a FED Chairman potential. Shella Bair says she wants to remove Banks CEO. She is the Terminator type. and Banks need this type of Boss, tough, no nonsense, handson.

Temasek Holding has sold its stake in BoA, in late March, a bit premature. Obviously they dun employ good strategist like me. This remove an big impediment for Nationalisation of US Banks. For the past week, now and next weeks, the Sovereign Wealth Funds like Dubai investment, and our Prince Alwaeed probably are emptying their holdings of US Banks at current levels.

Soon in July, the Banks would need to file with SEC on their level 3 assets. Then the truth would be out. may be before Qtr 2 earnings. I suspect that Good Samaritans (GS) is holding the market at current level to allow the Treasury to bailout the SWF.

And I know of a lot of bankers selling products linked to the Banks, like Citigroup Equity Linked Notes to the unknowing retails. And of course mutual funds buying as well.

Today the TECHs are holding up. The Quick monies are rotating into the sectors on a daily basis, not holding any long positions. Like strong Financial yesterday, weak Tech yesterday, weak Financials today, weak Tech today. Suspect they are long bias. This is good for catching stops.

Geithner says he would stand behind GM in stakeholders talk. Good, bring along some butter for lubrication, Tim.

Utilities not doing well, utility supply sale not doing well, undersubscribed. Excess Capacities, excess power stations, nuclear stations, wind farm. Demand not there, Crude demand also down.

Excess capacities everywhere, excess banks, one Lehman down no big deal. excess car production capacities, probably excess media companies, excess casinos, overleveraged. The Deleveraging has yet to complete.

EurUSD just touched 1.3485, setting up for next week ? with 2 more hours into market close, let us see if SPX touch the sacred 872 and hold there. now at 884. a 12 point drop a tall order.

Looks like we got to keep Euro 1.5000 for another day.

Thursday, May 14, 2009

14 May Looks may be deceiving

Traders must be awfully bored with the Whipsawing. Dun be surprise we may have a break out today. DXY is now out of its downtrend line, so does USDJPY. we may have SPX going to 805-830 near term. may be 760 by memorial day.

14 May Good Samaritans

today my banker called me the 5th time this week, trying to push a product. The last call she was trying to sell Equity Linked Notes on Citigroup with 80% downside. If stock price above purchase, I get a good yield like 10%/annum. If it falls below 80% of purchase price, I would have to buy the stock itself.

I.e. if it falls below 2.8 (3.5 now), I would become a Citigroup shareholder. Truly honored.

Come to think of it, the Good Samaritans (GS) with their programmed buying has created a great environment for

(a) bank products sales, at least banks have a reason to retain their employees.

(b) government started to sell land (e.g. a successful sale by HK government last week).

(c) many IPOs launched in China, including some big ones

(d) flood of secondary stock offerings by banks

(e) corporate bonds issues

(f) pump prices start rising

In a nutshell, a flurry of activities. And many people calling bottoms. calling Green Shoots, Glimmer of hope, etc.

The problem is, I am still looking for a job and not even an interview. Think I would leave it to the Good Samaritans to save the world.

Hope they do more so that companies start spending on projects and be more generous with pay. Am ernestly waiting........

My Good Samaritan.

I.e. if it falls below 2.8 (3.5 now), I would become a Citigroup shareholder. Truly honored.

Come to think of it, the Good Samaritans (GS) with their programmed buying has created a great environment for

(a) bank products sales, at least banks have a reason to retain their employees.

(b) government started to sell land (e.g. a successful sale by HK government last week).

(c) many IPOs launched in China, including some big ones

(d) flood of secondary stock offerings by banks

(e) corporate bonds issues

(f) pump prices start rising

In a nutshell, a flurry of activities. And many people calling bottoms. calling Green Shoots, Glimmer of hope, etc.

The problem is, I am still looking for a job and not even an interview. Think I would leave it to the Good Samaritans to save the world.

Hope they do more so that companies start spending on projects and be more generous with pay. Am ernestly waiting........

My Good Samaritan.

Wednesday, May 13, 2009

13 May 9 Trillions of FED offbalance sheet items unaccounted for

http://www.youtube.com/watch?v=PXlxBeAvsB8&eurl=http%3A%2F%2Fwww%2Emikevadon%2Eblogspot%2Ecom%2F&feature=player_embedded

If FED is willing to spend 9 Trillion. Bernanke might as well have written down every housing mortgage by 9 Trillion, then the whole crisis would have solved. what a waste of Tax Payer Monies.

Think in 2010, we would see indictment of the key people in this crisis.

Today SPX touch 888.06 low. (888 is Jesus in Greeek coding). Believe this would eb the low for today, and the battle for Angel and Demons premiering on 13 May (Europe). If 888 is broken, then the devil is banished back to hell, below 666.

If 888 held, then a retest of 930 is possible.

So far as of lunch time, 888 is holding well. hovering around 891.

OPEC released report that members actually increased output, instead of cutting. Perhaps 60 dollar oil is the cap for now. So far Euro managed only 1.3720.

Gold touched 930.

If FED is willing to spend 9 Trillion. Bernanke might as well have written down every housing mortgage by 9 Trillion, then the whole crisis would have solved. what a waste of Tax Payer Monies.

Think in 2010, we would see indictment of the key people in this crisis.

Today SPX touch 888.06 low. (888 is Jesus in Greeek coding). Believe this would eb the low for today, and the battle for Angel and Demons premiering on 13 May (Europe). If 888 is broken, then the devil is banished back to hell, below 666.

If 888 held, then a retest of 930 is possible.

So far as of lunch time, 888 is holding well. hovering around 891.

OPEC released report that members actually increased output, instead of cutting. Perhaps 60 dollar oil is the cap for now. So far Euro managed only 1.3720.

Gold touched 930.

Tuesday, May 12, 2009

12 May Euro broke out

Crude going to test 200da at 65. SPX support at 907, possibly to test 200d at 950.

Suspect Gold has a breakout. finally.

Obama on national TV asking corporate to cut healthcare cost, by discouraging employees from smoking, more exercise, etc.

OMG, now the American Presidents want to get into your life, after running Auto companies and Banks.

It is crazy America.

12 May Euro battle at 1.3560

So far the rating agencies have not downgraded US debt, never would they, though they were rumours in January.

The bankruptcy of US Federal Reserve would come in the form of a USD crisis. We are getting closer to it with the current recession.

(a) The Ferderal Reserve was not able to account for the Trillions on their books

(b) The stress test did not include assets, only the loans. Hence it is not an actual stress test.

If the FED include 5yr dated CRE securities in their TALF, then inflation expectation would break lose. (not inflation, but the expectation of it). Yields would go up, and mortgage rates would return to high level, when a fresh avalanche of ARMs are about to reset.

You can see the flood of secondary offers in the markets now, every corporate trying to raise cash. And that is the reason for this rally, to create an environment that the buyers can justify their purchases of equiies, new debts, etc.

Having said that believe the market would continue in range till OPEX, 900 to 930. trying to keep this rally alive as long as possible, until the corporate bails out. The excess liquidity FED has given is used to bail out the corporate.

It is just a matter of time when we enter into a protracted winter.

We contiue in the battle at the breakout.

By Europe open, the bag banks would have decided how to read Bernanke statement at Jerkyll island.

Would they decide to push Euro higher or stage a USD recovery.

The bankruptcy of US Federal Reserve would come in the form of a USD crisis. We are getting closer to it with the current recession.

(a) The Ferderal Reserve was not able to account for the Trillions on their books

(b) The stress test did not include assets, only the loans. Hence it is not an actual stress test.

If the FED include 5yr dated CRE securities in their TALF, then inflation expectation would break lose. (not inflation, but the expectation of it). Yields would go up, and mortgage rates would return to high level, when a fresh avalanche of ARMs are about to reset.

You can see the flood of secondary offers in the markets now, every corporate trying to raise cash. And that is the reason for this rally, to create an environment that the buyers can justify their purchases of equiies, new debts, etc.

Having said that believe the market would continue in range till OPEX, 900 to 930. trying to keep this rally alive as long as possible, until the corporate bails out. The excess liquidity FED has given is used to bail out the corporate.

It is just a matter of time when we enter into a protracted winter.

We contiue in the battle at the breakout.

By Europe open, the bag banks would have decided how to read Bernanke statement at Jerkyll island.

Would they decide to push Euro higher or stage a USD recovery.

Monday, May 11, 2009

11 May Important moment for Euro at 1.3700

I am put on Apocalypse Watch this week. Red Sun rising. Waiting for falling stars and Earthquake.

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/5286832/China-fears-bond-crisis-as-it-slams-quantitative-easing.html

Currency crisis ?

Some ranting on the market makers:

http://fofoa.blogspot.com/2009/05/why-all-paper-will-burn-in-plain.html

Euro in cup and handle formation. if 1.3700 is broken convincingly, look for 1.5000.

Stock has run up so far up, not likely to follow Euro as much. We may have a sceanrio of Rising Euro, Rising Gold, Falling Equities, Rising Crude. The story would be "Rising Inflation scares off Equities Investors".

We may see an exodus of monies from US markets, seeking better yields elsewhere, with greater risk taking.

Sunday, May 10, 2009

10 May Off to Vouliagmeni

I have not been travelling, and this coming week I would off to the Bilderberg meeting (14 to 16 May Athen), may be I would update you guys on the happenings. Last year this time, was the China Sichuan Earthquake, followed by the surge in Crude prices, and then the collapse.

http://www.grreporter.info/statiaen.php?mysid=1823&t=16

The coincidence of last yr Bilderberg Virginia meeting and the surge in crude prices can be attributed to the China Sichuan Earthquake. Bços of the Earthquake, the China military needs to fly countless sorties of helicopter and planes, this skewed the demand in that few weeks.

As for this year Bilderberg, we would gather to talk about Sustainable Recoveries, how to beat the Kondratieff Winter cycle. This type of Anglo-Saxon groups (Iluminati, FreeMasons, etc) are typically Anti-China, Anti-Communism. I would not be surprised some members broach the topics of restoring Democracy in China (China was briefly a democracy after the Qing Dynasty, when the Kuomingtang party (incumbent Taiwan governing party) was holding the government for a while). The greater scheme of things would be to retore Anglo-Saxon rule over the world.

Watch how USD, Crude and Commodities behave next 2 weeks. (China is now lopsided onto Commodities investment, may be a lesson ought to be taught to bring them back to 10-30 years Treasuries).

Next week would be the watershed, with the Bilderberg meeting (14-16 May), Netanyahoo (15 May) in Washington. The Full Moon this month was 9 May, Opex on 15 May.

Pope Benedict just asked the Muslims and Christians to worship the GOD together. How shocking it would be for the Muslims to worship the GOD of Jesus.

The Iranian Nuclear capability and North Korean re-nuclearisation would be a topic of discussion as well.

Something big is going to happen, dun you think so ?

One eerie conclusion the group may have is that the current economy needs to plunge further to rid it of excesses faster inorder to escape from the grip of Kondratieff winter sooner.And the tool or mechanism to achieve that would be decided upon.

Some coming data points, all pointing to better forecast:

Bloomberg Survey

================================================================

Release Period Prior Median

Indicator Date Value Forecast

================================================================

Trade Balance $ Blns 5/12 March -26.0 -29.0

Federal Budget $ Blns 5/12 April 159.3 -20.0

Import Prices MOM% 5/13 April 0.5% 0.5%

Import Prices YOY% 5/13 April -12.1% -16.8%

Retail Sales MOM% 5/13 April -1.2% 0.0%

Retail ex-autos MOM% 5/13 April -1.0% 0.2%

Business Inv. MOM% 5/13 March -1.3% -1.1%

PPI MOM% 5/14 April -1.2% 0.1%

Core PPI MOM% 5/14 April 0.0% 0.1%

PPI YOY% 5/14 April -3.5% -3.8%

Core PPI YOY% 5/14 April 3.8% 3.4%

Initial Claims ,000’s 5/14 9-May 601 610

Cont. Claims ,000’s 5/14 2-May 6351 6400

CPI MOM% 5/15 April -0.1% 0.0%

Core CPI MOM% 5/15 April 0.2% 0.1%

CPI YOY% 5/15 April -0.4% -0.6%

Core CPI YOY% 5/15 April 1.8% 1.8%

Empire Manu. Index 5/15 May -14.7 -12.0

Net Long Term TICS $ Bl 5/15 March 22.0 30.0

Total TICS $ Blns 5/15 March -97.0 50.0

Ind. Prod. MOM% 5/15 April -1.5% -0.6%

Cap. Util. % 5/15 April 69.3% 68.8%

U of Mich Conf. Index 5/15 May P 65.1 66.5

================================================================

Monday, no important data. pull back ritual. Surprise Retail sales with surge, then end with the May Empire Manufacturing Index on Friday. Friday is also OPEX.

Definitely not a week to take aggressive Short positions. A cautious long to ride the rise is advised. As we are into the end stage of the current rally.

http://www.grreporter.info/statiaen.php?mysid=1823&t=16

The coincidence of last yr Bilderberg Virginia meeting and the surge in crude prices can be attributed to the China Sichuan Earthquake. Bços of the Earthquake, the China military needs to fly countless sorties of helicopter and planes, this skewed the demand in that few weeks.

As for this year Bilderberg, we would gather to talk about Sustainable Recoveries, how to beat the Kondratieff Winter cycle. This type of Anglo-Saxon groups (Iluminati, FreeMasons, etc) are typically Anti-China, Anti-Communism. I would not be surprised some members broach the topics of restoring Democracy in China (China was briefly a democracy after the Qing Dynasty, when the Kuomingtang party (incumbent Taiwan governing party) was holding the government for a while). The greater scheme of things would be to retore Anglo-Saxon rule over the world.

Watch how USD, Crude and Commodities behave next 2 weeks. (China is now lopsided onto Commodities investment, may be a lesson ought to be taught to bring them back to 10-30 years Treasuries).

Next week would be the watershed, with the Bilderberg meeting (14-16 May), Netanyahoo (15 May) in Washington. The Full Moon this month was 9 May, Opex on 15 May.

Pope Benedict just asked the Muslims and Christians to worship the GOD together. How shocking it would be for the Muslims to worship the GOD of Jesus.

The Iranian Nuclear capability and North Korean re-nuclearisation would be a topic of discussion as well.

Something big is going to happen, dun you think so ?

One eerie conclusion the group may have is that the current economy needs to plunge further to rid it of excesses faster inorder to escape from the grip of Kondratieff winter sooner.And the tool or mechanism to achieve that would be decided upon.

Some coming data points, all pointing to better forecast:

Bloomberg Survey

================================================================

Release Period Prior Median

Indicator Date Value Forecast

================================================================

Trade Balance $ Blns 5/12 March -26.0 -29.0

Federal Budget $ Blns 5/12 April 159.3 -20.0

Import Prices MOM% 5/13 April 0.5% 0.5%

Import Prices YOY% 5/13 April -12.1% -16.8%

Retail Sales MOM% 5/13 April -1.2% 0.0%

Retail ex-autos MOM% 5/13 April -1.0% 0.2%

Business Inv. MOM% 5/13 March -1.3% -1.1%

PPI MOM% 5/14 April -1.2% 0.1%

Core PPI MOM% 5/14 April 0.0% 0.1%

PPI YOY% 5/14 April -3.5% -3.8%

Core PPI YOY% 5/14 April 3.8% 3.4%

Initial Claims ,000’s 5/14 9-May 601 610

Cont. Claims ,000’s 5/14 2-May 6351 6400

CPI MOM% 5/15 April -0.1% 0.0%

Core CPI MOM% 5/15 April 0.2% 0.1%

CPI YOY% 5/15 April -0.4% -0.6%

Core CPI YOY% 5/15 April 1.8% 1.8%

Empire Manu. Index 5/15 May -14.7 -12.0

Net Long Term TICS $ Bl 5/15 March 22.0 30.0

Total TICS $ Blns 5/15 March -97.0 50.0

Ind. Prod. MOM% 5/15 April -1.5% -0.6%

Cap. Util. % 5/15 April 69.3% 68.8%

U of Mich Conf. Index 5/15 May P 65.1 66.5

================================================================

Monday, no important data. pull back ritual. Surprise Retail sales with surge, then end with the May Empire Manufacturing Index on Friday. Friday is also OPEX.

Definitely not a week to take aggressive Short positions. A cautious long to ride the rise is advised. As we are into the end stage of the current rally.

Saturday, May 9, 2009

9 May a new economics paradigm - InDeflation (registered Trademark)

Target for the SPX is 956. Now we are at about 930. 26 more points, easily attainable in a day. Either we go straight up, or a pullback on Monday, and a snap rally towards 956.

In case you have not noticed, EURUSD broke out to 1.3650. 1.3570 and 1.3600 is the tendline connect 1.6000 and 1.4700. Euro touched its bottom in Nov last yr, and has been consolidating between 1.3000 and 1.3500 range.

Crude bottomed sometime in Jan, and reached 55, and now broke 55 and heading towards 80. Crude usually stay in its trend for a extended period.

We may see Euro back towards 1.5000 while Crude towards 80 easily

As US economy recovers, it needs to boost its export. Hence once more the US administration is paying lips service to their mantra "Strong USD is in the interest of the nation".

As the current equities rally has exceeded its fundamentals, the only way up is to have some form of currency depreciation. Stock market may be up in USD dollars term, it actually stays the same if not decline vis-a-viv the Dollar Index.

When Crude rises to 80, we would have the onset of Stagflation.

Bernanke was brash when he told the House panels that he wold be bored in the future when the crisis ends. I think his biggest headache is still coming.

Bernanke who claims to be the student of Depression, who champions QE or monies dropping from the helicopter, has to aid his methods with PR campaigns, market timings, MTM, ban shortselling. It is like the student who fudge the experiments to get the results.

When economy slows, the majority who has jobs just cut down on spending. When inflation comes, everybody is affected. In fact studies show that in inflation times, people tend to go to the streets and protest.

Imagine from now till next yr US midterm election, we have ample time for CPI to rocket to 5% or more, when crude possible would zig zag above 100.

Not to mention, countries worldwide would be in protest. a negative economy with high oil prices would essentially kill of quite a lot of incumbent governments.

Then governments would have to rollback their stimulus packages and hike rates at the same time.

For the Obiwan administration, their objectives are essentially to maximise wealth for the wallstreet. E.g. Chairman of NY Fed actually buys shares of GS, and now with millions dollars of gains. If Obiwan does not keep his bunch of money mongers at check, the Democrats would once cede their majority to Republicans when Inflation is running amock on American mainstreet.

Obiwan is probably surrounded by more Money Mongers than truly patriotic people who wants to upkeep the moral, principals and sanctity of American values. An infatuation with saving the Banks have left everything on the sideline, e.g. its allies, its friends, long held American values, etc. No wonder Volcker, a true patriot, has been mumb all the while.

This weekend, there is a gathering of Central Bankers in Basel. Let see if they have the political clout to nip inflation in the bud.

For me I am doing my thesis, I would coin it as "A new economic paradigm: Indeflation", hopefully I would get Nobel Prize one day, and be as famous as Adam Smith, Black Sholes, etc.

Indeflation is a economic phenomenon when the economy display both symptoms of Inflaiton and Deflation at fast alternating periods on a global scale. It is economic volatility which would lead eventually to the collapse of capitalism, and hence forth the Kondratieff Winter.

Bernanke should have known that if he can arrest deflation within a span of 6 months, Inflation can come back as quick.

As stress test is over, it starts off a flurry of banks mergers and acquisitions, Banks trying to runaway from the Government, would offers itself up for grabs. Even executives of healthy banks would want to get out of the game, with the Congressional investigation panel on the subprime debacle starts their work. Hence banks get bigger, getting to Big to Fail once more, while the Toxic assets just snowball. Some Banks stock would rie, others would fall. It depends on which ones you own. At least one major bank would have to fail. So far Lehman Brother is just an investment company. By the end of this yr, a lot of familiar names like Morgan Standley, JP Morgan, Citi, BAC would not be around.

The best predictions is that the economy would now shift from Deflation to Inflation and then back to Deflation within a span of 1-2 years, the volatility would lead to the destructions of productivity, innovation. And when the volatility dies down, we would enter an extended period of inactivity, a.k.a the Kondratieff Winter.

In the next 10-20 years, we would see a very different America. It would be carved up into several blocks of states each with its own autonomy. The recent Texan tea party marks the beginning.

As in Chinese saying: "the long they merge, they would separate. The long the separate, they wold merge". Possibly China, Russia would enter into alliance with separte blocks of states. E.g. China with dominance on the Western Coast, while the Europeans with the Eastern Coast. The Republicans (whites) in the South.

The Federal Reserve would be delisted within the next 5 years (there is already a Congressman tabling such a bill), when they screw up this coming In-Deflation era (an economic term coined by me in my PhD thesis). A new World Reserve currency wold emerge, possibly in Yuan, if not in a form dominated by Chinese Yuan.

Coming to the Autoworkers, if the Baal is so powerful, he would have prevented the Chrysler bankruptcy, unless the wish is otherwise. Now we watch GM.

As for the Swine Flu, when August/September comes, a new strain more virulent would be rampaging the world. This new strain is so devastating that death occurs within 5 days. Though I would not expect massive death, as hygiene, containment are much better than in 1918. Still we would expect hundred thousands death. The new vaccine under devleopment now would be useless against this strain. I suspect this new strain would have a bigger characteristics of Bird flu virus, and the place it emerges may just be in China.

By the way, the Israeli do not have much time left to rid Iran of their nuclear reactors.

http://www.haaretz.co.il/hasen/spages/880507.html

Look what North Korea is doing, it is restarting its nuclear reactors. And US is helpless. Seems like Hilary is more like a charity parties diplomat. With Crude rising, Admadinejadd probably has more monies to acquire the knowhow to equip the warheads. I guess our CIA folks are sitting at their desk twisting their thumbs losing guard (just as Clinton first yr in office). Probably they have no morale with an outsider as their boss, and cuts in the Federal budgets.

While US interest in middle-east is to keep the peace, without much consideration of the JEWS. (with a Black President, the Jews have lesser influence on the adminstration).

Iran would probably have gotten his first mini-nuclear bomb by yr end, and probably commercialising them. While the Jews live in perpetual fear of a nuclear morning.

Moses who led the Israelis was a Jew himself, he is not an Eqyptian who turn good. And Israeli has to understand that they would be facing the next exodus when its countryman starts running away from the nuclear circumference.

Obiwan is summoning Netanyahoo to white house on May 18 2009 (A white house with a Black President, and so it rhymes). Just as the Eqypt Pharaoh summons Moses and ask him to compromise. In fact Obiwan wants the Isreali to recognise the Palestinian states, and talk peace with people Hezbollah, the Hamaz. Wow !!! imagine Moses get the Pharaoh consent to leave Eqypt at first request.

The Jews would face the coming third persecution by the Beast who came from the middle of the Ocean. Now it becomes clearer as 100 days have past, when you call a Beast the Beast (Baal).

As you all can see the Four Horseman of Apocalypse is now showing their shadow.

this is a long term prediction, not suitable for short term trading. We are still in a bull trend in a long term Bear market.

So much for a weekend, I expect a continous rise in Equities towards SPX at 200 day moving average at 950 (just above Christmas high of 944, window dressing). Euro to speed towards 1.4000, and Crude to march towards 75.

At SPX=888 (Jesus code in Greek is 888), the monies monger did not heed Gods advice and ram past it (just as it bounced off Devil's 666). More sinister things are going to happen to human kind. This rally has shown its nature as the Rally of the Devil. Little wonder it bounced from 666.

Meanwhile, I am watching The Ten Commandments. Moses said he will wait for God to tell the the way to the promised land. Behind is Eqypt, and infront is the Desert. Moses said God does not fight the war for them, HE would help when the time comes. A man with pride protects his children, his family.

Moses said today there would be no mircale, they have to fight. They were banned from holding weapons for 400 years, and today that would change.

On a thread of faith, the Jews step into the Desert, the unknown.

God provide you for what you need each day no more no less. Hence you trade just to make a living, not be as filthy rich as the likes of the Bankers, the Presidents' man. Because they would have their days of reckoning, not now, but in due time.

9 May Inflation

today is the day before Full Moon, and something important is supposed to happen. And indeed something happened, Euro broke through the multi yr down trend line stretching from 1.6000 to 1.4700 towards 1.3570.

Despite ECB new QE stance, Euro is rallying, going to catch those who short Euro by surprise.

While GBP is going to break 1.5200 as well.

Crude is going to cross 60 next week. Hyper inflation era is starting on this date 9 May, pushing USD a step closing to Banana paper status.

Meanwhile expect another leg up for Equities before next Friday OPEX.

if you are a diehard shortees, wait for 954 200 days moving average, possibly 960.

meanwhile just ride the GS/PPT wave for some quick profits.

Bernanke has to decide this weekend, USD or the Equities/Treasuries yield.

higher Treasuries yield because monies flowing away from Treasuries into commodities, Crude and Equities.

Long dated Tbills no longer sought by China, means demand for USD lessen.

This may be the trigger for a USD collapse, with China scrambling to the door selling its Treasuries back to FED.

Can Bernanke call a stop to the PPT/GS programmed buying ?

Friday, May 8, 2009

7 May Scott Whisky night

attended a function by a Scottish Whisky in collaboration with my private banker. The event is held at a swanky seaside resort, something like Sausilito with lots of private yatches, and also a lot of newly built condos.

It was time indeed for the Bank, as market has recovered, and everybody is scrambling to buy, probably they have front run this recovery as well.

Then Banker also bought Citi at 4 dollars before 9 March and holding. A lot of this frontline banking staff invest to supplement their commssions. I had to put on a brave front and says that Citi is a good buy in 2-3 years time frame.

After a few round of Whisky, I annouce that now is the good time to buy stocks to the table.

One Banker was saying "after the recession", the portion of Whisky has shrunk.

I had a good night with 3 glasses of Carbonet, and at least 5 tiny glasses of Whisky. Then I drove and lost my way amidst the cluster of Condos in the night. I saw lots of empty units, (some occupied) and a lot more coming.

Then it reminded my of Roubini talk of "excess capacity" this week.

One of Banks biggest customers are the Real Estate developers. The Real Estate developers literally loan the entire cost of development. When they cannot sell they carry the major portion of the loan on their books. Banks also carry the "Bad Loan" and most unwilling to foreclose on the developers.

The property boom has yet to deflate, at least the Banks and Developers are hiding them under their cloak.

There are recent news from LA, California of people bidding up foreclosed properties. These evidence may be staged, or a few out of the millions of forecloased homes on the books of the Banks. When foreclosed homes sell at bargaining prices, the entire neighbourhoold suffers.

When people starts losing jobs, or bosses less confident of their next pay, they are less willing to loan to buy properties. ( I jst read in Financial Times today that some analyst say the recovery in properties would be faster than expected).

Hence literally the Banks are insolvent. And the Banks and Governments are hopping that the reflation, with time would raise capital, improve confidence.

The market is on a thread of Confidence or Trust.

What trust is there if denail of "Mark to Market" prevails ? and Banks can manipulate their books, earnings to deceive the majority of the Public. Anyway, the Public got to gain because of the better 401K.

Unless you can print monies accepted by the Public, you would not want to get in the way of the Big Game. As a trader, you would just ride along and put in Trailing Stops.

Bernanke spoke yesterday and gave a positive spin, so did Geithner. (as I did at my table).

When the Game end, it is going to be awfully painful. When it end, think the FED would be history. It started in the last Depression and it would end with the next.

Meanwhile waiting for my QQQQ at 38.

It was time indeed for the Bank, as market has recovered, and everybody is scrambling to buy, probably they have front run this recovery as well.

Then Banker also bought Citi at 4 dollars before 9 March and holding. A lot of this frontline banking staff invest to supplement their commssions. I had to put on a brave front and says that Citi is a good buy in 2-3 years time frame.

After a few round of Whisky, I annouce that now is the good time to buy stocks to the table.

One Banker was saying "after the recession", the portion of Whisky has shrunk.

I had a good night with 3 glasses of Carbonet, and at least 5 tiny glasses of Whisky. Then I drove and lost my way amidst the cluster of Condos in the night. I saw lots of empty units, (some occupied) and a lot more coming.

Then it reminded my of Roubini talk of "excess capacity" this week.

One of Banks biggest customers are the Real Estate developers. The Real Estate developers literally loan the entire cost of development. When they cannot sell they carry the major portion of the loan on their books. Banks also carry the "Bad Loan" and most unwilling to foreclose on the developers.

The property boom has yet to deflate, at least the Banks and Developers are hiding them under their cloak.

There are recent news from LA, California of people bidding up foreclosed properties. These evidence may be staged, or a few out of the millions of forecloased homes on the books of the Banks. When foreclosed homes sell at bargaining prices, the entire neighbourhoold suffers.

When people starts losing jobs, or bosses less confident of their next pay, they are less willing to loan to buy properties. ( I jst read in Financial Times today that some analyst say the recovery in properties would be faster than expected).

Hence literally the Banks are insolvent. And the Banks and Governments are hopping that the reflation, with time would raise capital, improve confidence.

The market is on a thread of Confidence or Trust.

What trust is there if denail of "Mark to Market" prevails ? and Banks can manipulate their books, earnings to deceive the majority of the Public. Anyway, the Public got to gain because of the better 401K.

Unless you can print monies accepted by the Public, you would not want to get in the way of the Big Game. As a trader, you would just ride along and put in Trailing Stops.

Bernanke spoke yesterday and gave a positive spin, so did Geithner. (as I did at my table).

When the Game end, it is going to be awfully painful. When it end, think the FED would be history. It started in the last Depression and it would end with the next.

Meanwhile waiting for my QQQQ at 38.

Thursday, May 7, 2009

7 May GS at 140.36 high

GS reached new high at aboutn 2-3 pm ET on Wed.

In Asia markets, the buying by retail has pettered off, probalby thinking it is a hoax, last minute Funds pushing up triggered short covering by the weak shorts.

In Asia markets, the buying by retail has pettered off, probalby thinking it is a hoax, last minute Funds pushing up triggered short covering by the weak shorts.

Wednesday, May 6, 2009

6 May an impatient Bull

6 May day after SPX new high at 907

join in the bull for some targets. watch double bottom target of NDX. Watch GS at 140. GS today high is 136.20.

Gold has been higher, blamed it on weaker USD. Many traders expecting Gold to drop towards 800.

SPX has touched the upper channel of rising trend at 907 and bounced off. If bear takes over, 850 would be a reasonable pull back target. Otherwise SPX may just surge up after Thursday stress test result towards 38.2 retracement level of wave 3 at 960.

Eurusd has not touched the upper down trendline from 1.6 to 1.4700. quite risky ahead of ECB meeting (Thursday) also FED Stress Test day to long Euro. may be Euro spike to touch 1.3560 and then fall off. OR Euro has already started its decline towards 1.2400. a 1000 pips drop from here would be a good trade. However keep stops tight, incase surget towards 1.3700 happen, and this would constitute a major breakout for Euro.

Tit for tat, if 888 is violated, 666 would not hold either.

Monday, May 4, 2009

4 May Jesus defeated. Bear market is over as declared by national TV.

888 has been surpassed to a high of 897, now hovering below 900 contemplating.

there is the double bottom target for SPX. While Financial do rise, but not as much, the gap up of SPX seems bullish towards eventual 915.

Obama speaking at 11 am ET outlining international tax proposal, i.e. no more offshore tax haven for US companies.

Monies now has no where to hide. Is this another Bush era Homeland repatriation plan ? which led to strong USD in late 2005 ?

Would Wallstreet vote with their 2 feet ?

Now everywhere we see Daffodils.

Seems like all the good news are out.

Bears stay aside. Now CNBC says Banks 1 Trillion in capital reserves, wow!!!!

Tiny Tim (who had problem passing his confirmation with his tax problem) is talking about tax cheats. Obiwan administration is now so pathetic. A bunch of clowns doing PR and smoke screen.

CNBC now declares the Bear market is over

there is the double bottom target for SPX. While Financial do rise, but not as much, the gap up of SPX seems bullish towards eventual 915.

Obama speaking at 11 am ET outlining international tax proposal, i.e. no more offshore tax haven for US companies.

Monies now has no where to hide. Is this another Bush era Homeland repatriation plan ? which led to strong USD in late 2005 ?

Would Wallstreet vote with their 2 feet ?

Now everywhere we see Daffodils.

Seems like all the good news are out.

Bears stay aside. Now CNBC says Banks 1 Trillion in capital reserves, wow!!!!

Tiny Tim (who had problem passing his confirmation with his tax problem) is talking about tax cheats. Obiwan administration is now so pathetic. A bunch of clowns doing PR and smoke screen.

CNBC now declares the Bear market is over

Saturday, May 2, 2009

2 May Baal

The belief that Satan is in Hell is a likely product of cartoons and movies rather than what is portrayed in the Bible. The Bible states that he still roams heaven and earth. Job 1:6 states that Satan appeared with other angels "before the Lord." Presumably in heaven. When God asked Satan where he had been, Satan replied, "From roaming through the earth and going back and forth in it." 1 Peter 5:8 declares, "Your enemy the devil prowls around like a roaring lion looking for someone to devour."

Satan will be cast into the lake of burning sulfur (Hell), but it is only after the battle involving Gog and Magog (which means the nations of the earth). When the enemies of God are defeated, "the devil, who deceived them, was thrown into the lake of burning sulfur, where the beast and the false prophet were thrown." Rev 20:7-10 (New International Version).

Hence Satan is above hell.

Satan will be cast into the lake of burning sulfur (Hell), but it is only after the battle involving Gog and Magog (which means the nations of the earth). When the enemies of God are defeated, "the devil, who deceived them, was thrown into the lake of burning sulfur, where the beast and the false prophet were thrown." Rev 20:7-10 (New International Version).

Hence Satan is above hell.

2 May Chrysler

Now politics is even above law, bankruptcy code. seems like it is quite meaningless to be a bondholders, or secured creditors nowadays.

7 May is the release of the Stress Test, instead of Monday. Perhaps the game plan would be for a pullback on Monday, followed by continous rise. Whether it would break 888 is a question.

The Stress Test result would be glorious, the market reaction unknown.

The market has very much reflected the current bout of good economic data. Economy is indeed recovering, and the Swine Flu is subsiding.

It is all goldilock once more.

7 May is the release of the Stress Test, instead of Monday. Perhaps the game plan would be for a pullback on Monday, followed by continous rise. Whether it would break 888 is a question.

The Stress Test result would be glorious, the market reaction unknown.

The market has very much reflected the current bout of good economic data. Economy is indeed recovering, and the Swine Flu is subsiding.

It is all goldilock once more.

Friday, May 1, 2009

1 May 888

In Greek, the name of Jesus is spelled I H S O U S (iota, eta, sigma, omicron, upsilon, sigma). Substituting in the Greek numeral system the equivalent numerical values to each letter in the name of Jesus and adding them up, the total is 888.

When Angel Lucifer rise to meet Jesus, guess what Jesus tells Lucifer ?

When Angel Lucifer rise to meet Jesus, guess what Jesus tells Lucifer ?

1 May Volcker has spoken

before the FOMC rate decision, Bloomberg interview Paul Volcker, ex Fed chairman, who raise rates to 10% to curb runaway inflation. He expects the economy to level off. And he stressed that the Banks would not be nationalised, and Banks still have problems.

The significant part of the FOMC was what they did not say. They did not announce further purchase of Treasuries.

The last annoucement has generated the rise from 750 to 888 almost 130 points. The effect of monies printing is obvious, and the FED is pulling back.

This would give grounds for the bulls to halt the rally in due time. This has stopped USD index from making a drop through significant support.

We would see USD holding strong, Euro to drift lower towards 1.2400 from current 1.3200. How far the Stock market would pull back, is not known yet. Gold would probably retest 1000, now in the beginning stage of wave 3 up.

The significant part of the FOMC was what they did not say. They did not announce further purchase of Treasuries.

The last annoucement has generated the rise from 750 to 888 almost 130 points. The effect of monies printing is obvious, and the FED is pulling back.